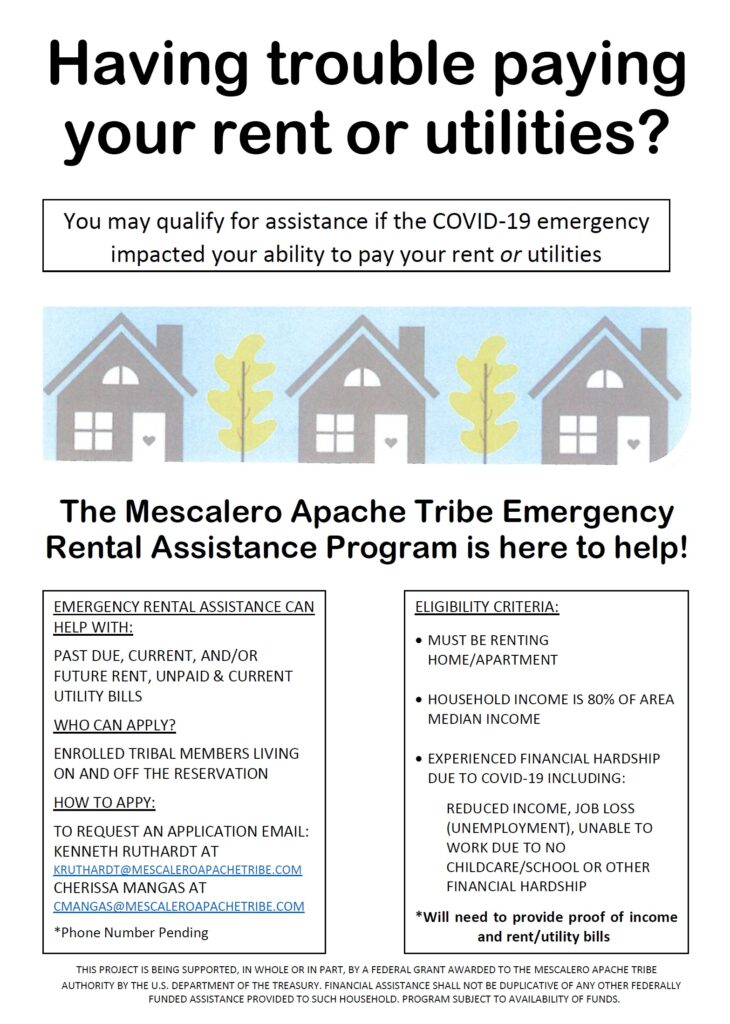

ATTENTION: Mescalero Apache Tribe Housing Department tenants living at:

- Gayton Ridge

- Oak Drive

- Elderly Units

- Pena

- Palmer

- Carrizo Trails

- Lower Flats

- Windy Point

You can be worry free for one year! The Emergency Rental Assistance Program will pay your rent and utilities for 12 months.

If an application has already been filled out with the ERA Program or sent in, there is no need to sign up again.