We’re excited to share that emergency food boxes will be available for pick up today at 10:00am at the Elderly Center! This is a self serve event open to everyone in our community, so please feel free to come by and grab what you need.

We’re excited to share that emergency food boxes will be available for pick up today at 10:00am at the Elderly Center! This is a self serve event open to everyone in our community, so please feel free to come by and grab what you need.

ENCINO FIRE UPDATE:

Today approximately 2:30pm, a new fire was responded in the Encino Well area on the reservation, covering approximately 6 acres. The fire is burning in grass, brush, and light timber.

RESPONSE TEAM:

*MAFR has reported with two engines

*BIA Forestry has responded two engines along with one contract Engine.

*The U.S. Forest Service (USFS) has also contributed two engines and additional personnel from Sacramento Hot Shots and Smoky Bear Hot Shots.

Currently, there are no threats to nearby towns or housing areas, and the containment lines are holding steady. Firefighting resources will remain on scene to monitor the situation, and operations will continue tomorrow.

Attention, everyone! We’ve noticed an increase in measles cases in our community, and it’s crucial to stay informed and vigilant. Here are some signs to watch for:

PREVENTION IS KEY!

Let’s work together to keep our community safe and healthy!

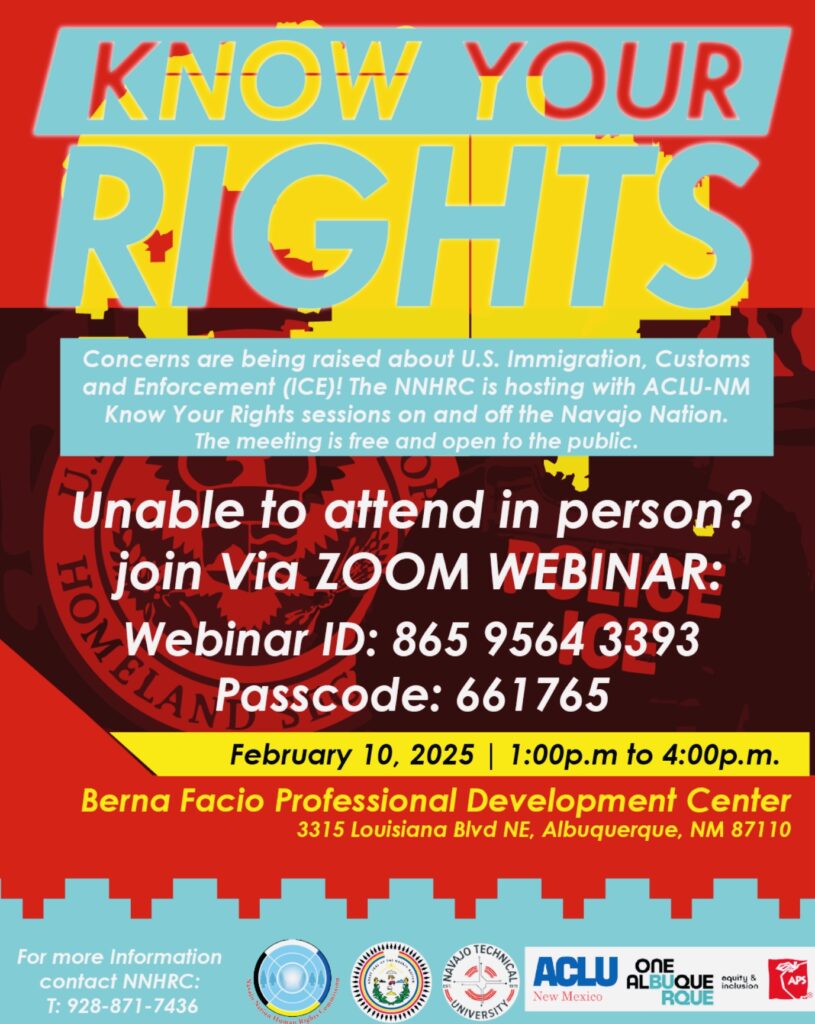

THERE IS A SESSION HAPPENING TODAY AT 1:00pm THIS AFTERNOON ABOUT CONCERNS WITH U.S. IMMIGRATION, CUSTOMS AND ENFORCEMENT (ICE). THE MEETING IS FREE AND OPEN TO THE PUBLIC.

Sewing lab will be open Friday (02-07-25) from 10:00am to 4:00pm and on Saturday (02-07-25) from 8:00 to 4:00pm. Located at the Empowerment Building, come and make your own traditional clothing. Materials instruction will be provided.